When discussing ‘Precious Metals’ in financial markets, our instincts often drift toward Gold and Silver. However, defining a robust Platinum investment outlook for 2026 requires us to look at a metal that has historically commanded a higher premium than gold and plays an irreplaceable role in modern industry: Platinum (Pt).

From an investment perspective, Platinum differs significantly from Gold. While Gold acts as a ‘Currency’ and a safe haven, Platinum is strictly a ‘Hard Asset’ and a cyclically sensitive ‘Industrial Material’. In this post, we analyze the unique economic moat of Platinum and the investment opportunities it presents for 2026, from a quantitative portfolio diversification perspective.

1. Intrinsic Value: The Coexistence of Scarcity and Resilience

The primary reason Platinum holds investment value lies in its physical and chemical properties, specifically its ‘Absolute Scarcity’ and ‘Immutability’.

- Overwhelming Scarcity: Platinum is one of the rarest metals on Earth. While annual gold production is around 3,000 tons, Platinum production is merely 1/15th of that, at approximately 200 tons (6 million ounces). Its crustal abundance is also significantly lower than that of gold.

- Chemical Immutability (Noble Metal): Platinum does not dissolve in any acid except ‘Aqua Regia’ and never oxidizes or corrodes in air. This is a prerequisite for asset value preservation.

- High Density: With a specific gravity of 21.45, it is denser than Gold (19.3). A Platinum bar is noticeably heavier than a Gold bar of the same size, enhancing its appeal as a tangible asset.

2. Why Does Industry Insist on Platinum? (The Economic Moat)

Investors do not need to memorize chemical symbols. However, understanding why industries pay a premium to use Platinum despite the cost is crucial. Lack of substitutability implies strong price defense (Downside Protection).

① The King of Catalysts (Catalytic Power)

Platinum’s most powerful weapon is its ability to explosively accelerate chemical reactions without changing itself. Platinum atoms excel at temporarily binding gas molecules (like Carbon Monoxide or Hydrogen) to their surface and breaking them apart.

💡 Investment Insight: No material has yet been found that matches Platinum’s efficiency in purifying diesel exhaust or separating hydrogen to generate electricity. As long as the ‘Green Energy/Efficiency’ trend continues, Platinum demand is structurally secure.

② The Vessel Withstanding 1,768°C (High Melting Point)

Gold melts at 1,064°C, but Platinum withstands up to 1,768°C. This property is essential for ‘Glass Manufacturing’ and ‘High-Tech IT’. In the production of high-purity glass for smartphone screens (OLED/LCD) or optical fibers, the bushings that melt the glass must be made of Platinum. In these advanced processes where impurities are unacceptable, Platinum is the only alternative.

③ Peace Treaty with the Body (Biocompatibility)

Platinum is one of the few metals that does not trigger rejection reactions (allergies, oxidation) when in contact with human blood or tissue. It is a key raw material in high-value healthcare sectors, used in pacemakers, neurovascular coils, and anti-cancer drugs.

3. Market Analysis: Divergence and Opportunity

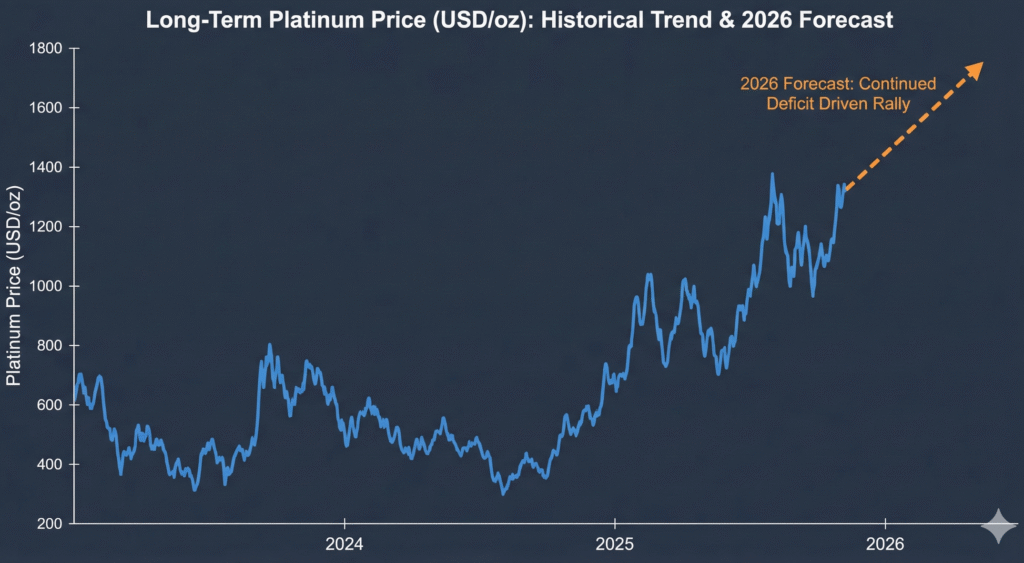

As of 2026, ‘Smart Money’ is focusing on the ‘Divergence’ between Gold and Platinum and the looming ‘Supply/Demand Imbalance’.

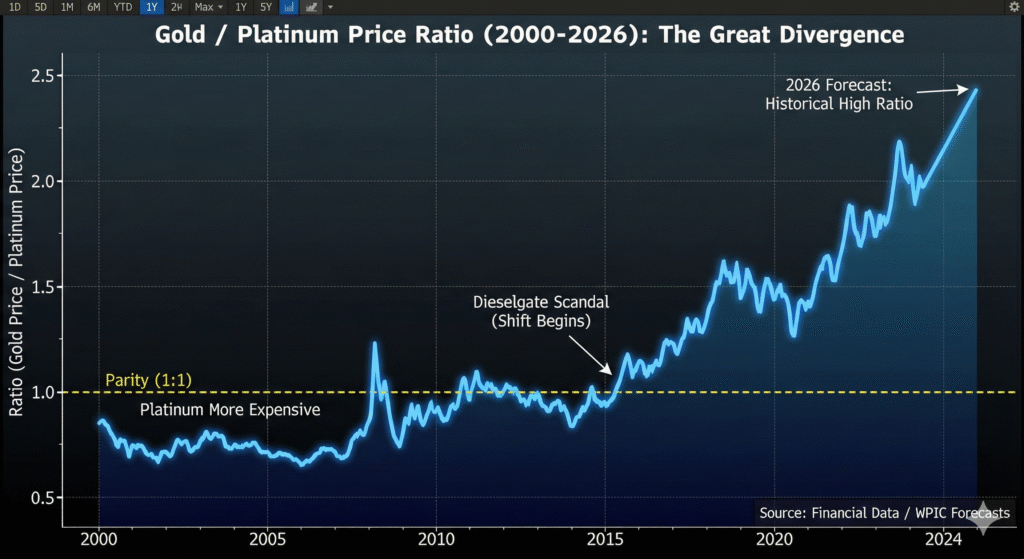

① The Signal from the Gold/Platinum Ratio

Over the past decade, Gold has trended upward due to safe-haven sentiment, while Platinum has been trapped in a box due to EV transition fears.

- Historical Norm (Pre-2015): Platinum generally traded higher than Gold (Ratio < 1).

- Current Status: Gold is more than twice as expensive as Platinum (Ratio > 2).

This indicates that Platinum is at the bottom of its historical band. From a statistical Mean Reversion perspective, Platinum offers significantly higher Upside Potential compared to Gold.

② Three Structural Drivers Pushing Prices Up

- Supply Crunch: South Africa, responsible for 70% of global supply, suffers from chronic power shortages and aging infrastructure. In an inelastic supply environment, any demand increase translates directly to price hikes.

- The Counterattack of Hybrids (HEV): As the full EV (BEV) transition slows, Hybrid vehicle sales are exploding. Hybrid engines start and stop frequently, leading to lower exhaust temperatures; to maintain purification efficiency, they require higher Platinum loadings than standard combustion engines.

- Substitution Effect: With Palladium prices spiking in recent years, automakers have begun substituting cheaper Platinum for Palladium in gasoline catalytic converters.

4. 2026 Economic Outlook & Risks

Beyond simple supply and demand, we must analyze the impact of technological shifts and regulations on Platinum prices.

✅ The Bull Case: Two Growth Engines

- The Key to the Hydrogen Economy (PEM Tech): Platinum is essential for PEM (Proton Exchange Membrane) electrolysis for hydrogen production and Fuel Cells for commercial vehicles (trucks/ships). As global Net Zero policies solidify in 2026, hydrogen-related demand will become visible.

- The Paradox of Regulation (Euro 7): Europe’s new emission standard, Euro 7, drastically lowers permissible limits. To meet this, the loading (amount of catalyst per vehicle) must increase, offsetting the potential decline in vehicle sales volume.

⚠️ The Bear Case: Structural Risks

- Acceleration of BEV Penetration: This is the biggest threat. If battery technology innovation spikes BEV market share faster than expected, automotive demand (40% of total) could face a structural collapse (Terminal Value Risk).

- Industrial Slowdown: Unlike Gold, Platinum is an industrial metal. A global recession or a downturn in China’s PMI could lead to a sharp price correction.

Conclusion

In summary, Platinum is an asset that “possesses the scarcity of a precious metal but rides the cycle of an industrial material.”

When incorporating raw materials into your portfolio, if you wish to bet on ‘Industrial Recovery’ and the ‘Hydrogen Economy’ beyond simple inflation hedging—and if current Gold prices feel burdensome—Platinum, currently in a historical undervaluation zone, may be a highly attractive option for capturing Alpha in 2026.