The Federal Funds Rate is one of the most important interest rates in the world. Set by the U.S. Federal Reserve (the Fed), it influences everything from mortgage rates and stock prices to global capital flows.

In this post, we’ll break down what the Fed’s benchmark rate actually means, why it’s expressed as a target range, and how it has evolved over the past decade.

1. What Is the Federal Funds Rate?

The Federal Funds Rate (often called the Fed rate) is the interest rate at which U.S. banks lend reserve balances to each other overnight.

It’s essentially the cost of borrowing short-term liquidity between financial institutions.

- Set by: The Federal Open Market Committee (FOMC) of the U.S. Federal Reserve.

- Purpose: To control inflation, guide borrowing costs, and stabilize economic growth.

- Mechanism: The Fed influences this rate through open-market operations, reserve requirements, and the interest it pays on reserves.

Because it affects nearly every other interest rate—like credit cards, auto loans, and mortgages—the Federal Funds Rate is often referred to as “the anchor of the U.S. economy.”

2. Why Does the Fed Use a Target Range Instead of a Single Rate?

Since 2008, the Federal Reserve has moved away from setting a single fixed rate and instead introduced a target range (for example, 5.25 – 5.50%).

Here’s why:In the past, the Federal Reserve (Fed) often set a specific figure for the federal funds rate (for example, 5.25%).

However, in recent years, it has adopted the practice of presenting the rate as a target range — consisting of a lower and upper bound (e.g., 5.00 – 5.25%).

The reasons for this shift are as follows:

(1) Changes in Market Liquidity and Reserve Conditions

After the 2008 Global Financial Crisis, the Fed launched large-scale quantitative easing (QE) programs and expanded bank reserves.

As a result, the banking system moved into what is now called an “ample reserves” regime, where excess reserves are abundant.

In this environment, the interbank funding market became less active, making it difficult for the Fed to control a single precise rate.

To address this, the Fed began setting a range rather than a single number, while using supporting tools — such as interest on reserve balances (IORB) and the overnight reverse repurchase (ON RRP) rate — to guide the actual market rate so that it remains within that range.

(Source: Liberty Street Economics, Federal Reserve Bank of St. Louis)

(2) Flexibility in Policy Implementation

A target range provides the Fed with greater flexibility in managing monetary policy.

When it announces an upper and lower bound, the market can move naturally within that corridor, allowing the Fed to fine-tune its stance more smoothly than by changing a single fixed number.

For example, if policymakers wish to adopt a slightly tighter or slightly looser stance, adjusting the range is an effective way to signal that nuance.

(Source: Bankrate.com)

(3) Communication and Signaling Function

By presenting a range, the Fed can more effectively communicate its policy stance to the market.

The width or position of the range helps signal whether the policy direction is tightening or easing.

Compared to announcing a single number, a range provides a softer and more flexible message to market participants, reducing potential volatility.

(Source: The Federal Reserve Board)

(4) Alignment with Operational Tools

The Fed currently influences market interest rates using two key instruments:

- Interest on Reserve Balances (IORB) — which serves as the upper bound, and

- Overnight Reverse Repurchase Agreements (ON RRP) — which serve as the lower bound.

These rates act as boundaries that keep the effective federal funds rate (EFFR) within the target range.

Hence, adopting a target range aligns well with the Fed’s modern operational framework, which relies on these supporting policy tools.

(Source: Liberty Street Economics)

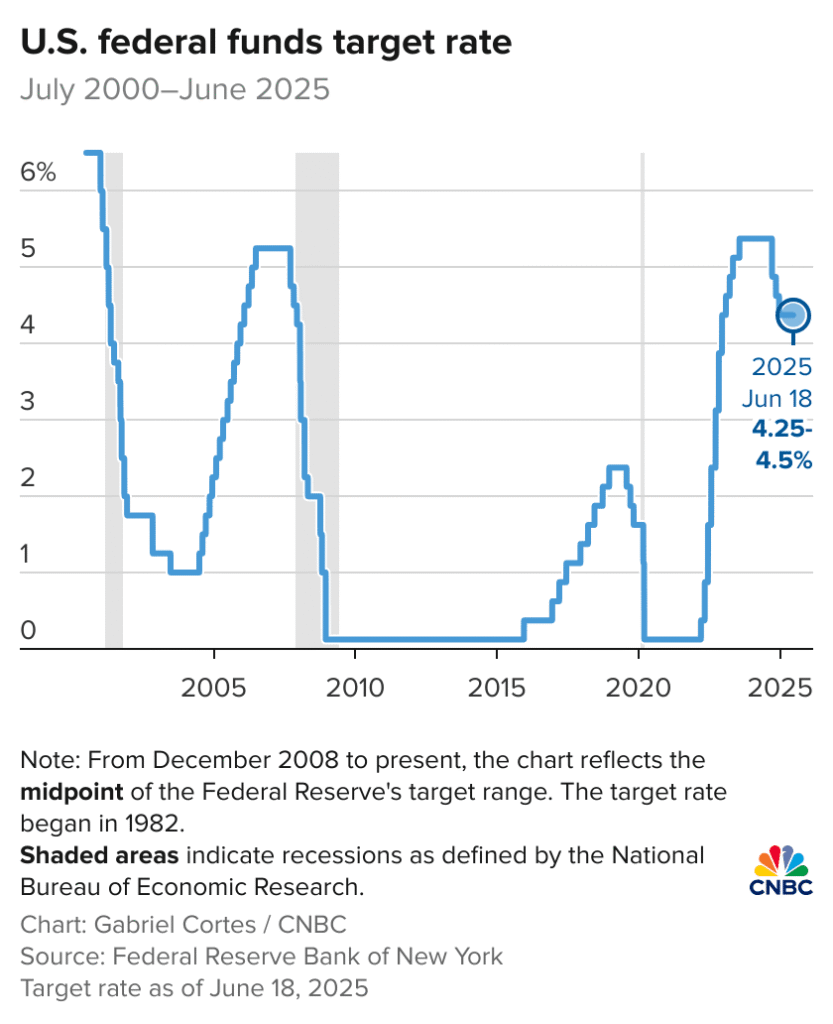

3. The Last 10 Years of Fed Rate History (2015–2025)

The past decade has been a rollercoaster for U.S. monetary policy.

Here’s a quick overview of how the Federal Funds Rate target range has changed:

| Year | Target Range | Key Events |

|---|---|---|

| 2015 | 0.25 – 0.50% | First hike since GFC |

| 2016 | 0.50 – 0.75% | Gradual tightening begins |

| 2017 | 1.00 – 1.50% | Ongoing normalization |

| 2018 | 2.25 – 2.50% | Peak of pre-pandemic cycle |

| 2019 | 1.50 – 1.75% | Mid-cycle adjustment (cuts) |

| 2020 | 0.00 – 0.25% | Emergency easing (COVID-19) |

| 2021 | 0.00 – 0.25% | Lower bound maintained |

| 2022 | 4.25 – 4.50% | Fastest hikes in decades |

| 2023 | 5.25 – 5.50% | Cycle peak |

| 2024 | 4.25 – 4.50% (late) | Start of easing bias |

| 2025 | ~4.00 – 4.25% | Early cut(s) from peak |

Trend summary:

– Ultra-low rates (2015–2021)

– Fastest tightening in 40 years (2022–2023)

– Gradual normalization and early easing (2024–2025)

You can track real-time updates via the Federal Reserve’s official interest rate page.

4. What This Means for Investors and Borrowers

- Rising Fed rates → Higher borrowing costs, stronger dollar, pressure on equities.

- Falling Fed rates → Easier credit conditions, potential boost for housing and tech sectors.

- Stable range → Sign of economic balance and inflation control.

Understanding these cycles helps investors align portfolios with macroeconomic trends.

Frequently Asked Questions

Q: What’s the difference between the Federal Funds Rate and the Discount Rate?

The discount rate is what banks pay when borrowing directly from the Fed, usually higher than the federal funds rate.

Q: How often does the Fed change the rate?

Typically eight times a year, during scheduled FOMC meetings, though emergency adjustments can happen.

Q: What is the current Fed rate?

As of late 2025, the target range stands around 4.00 – 4.25 percent, following the first rate cut since 2023.